Stocks have tumbled during the month of February, the S&P 500 is down by 3% currently. The market has become volatile with the futures of many stocks and companies being thrown into disarray.

This can make our job more difficult. Picking the monthly stock selection for March 2025. With the market being red across the board. How will we know what will eventually become green?

A Difficult Choice?

The stock market’s current volatility can be unsettling. With fluctuations and uncertainty looming, the idea of investing might feel daunting. It’s true, all investments carry inherent risks, and market downturns can amplify those concerns. However, history has shown that periods of decline can also present unique opportunities for long-term investors.

While market downturns might seem overwhelming, they are a recurring feature of the stock market. Throughout history, numerous periods of decline have been followed by periods of recovery and growth. This can be a strategic time to consider investing in well-established companies with a proven track record, potentially acquiring shares at a discounted price. The prospect of a subsequent market recovery can then offer the potential for substantial returns.

However, navigating these turbulent times requires careful consideration. Instead of focusing on specific stock picks, it’s crucial to prioritize fundamental analysis and long-term investment strategies. Identifying companies with strong financials, a history of resilience, and a solid business model can be invaluable during market downturns.

When evaluating potential investments during market declines, consider these key factors:

- Financial Strength: Look for companies with strong balance sheets, low debt, and consistent cash flow.

- Proven Track Record: Companies with a history of weathering previous market downturns and recessions often demonstrate resilience.

- Long-Term Growth Potential: Focus on companies with sustainable business models and the potential for long-term growth.

- Diversification: Diversifying your portfolio across different sectors and asset classes can help mitigate risk during market volatility.

Remember, investing during market downturns requires a long-term perspective and a disciplined approach. Avoid impulsive decisions driven by fear or speculation. Instead, focus on building a diversified portfolio of quality investments that align with your risk tolerance and financial goals.

So with that in mind, what are the top picks for March?

Honorable Mentions:

Duolingo (DUOL)

Everyone has heard of Duolingo, but just in case you haven’t. Duolingo is a free app that helps people learn languages, music and math. It uses games and rewards to motivate people into continuing their learning. Used by many people worldwide.

In February Duolingo share prices fell by over 9.21%. It has fallen by 17.47% in the last 5 days alone. What caused this?

A few factors have caused this rapid drop. Institutions have less of an appetite to invest in mid-cap stocks currently. Selling their shares in them to move their capital into other assets.

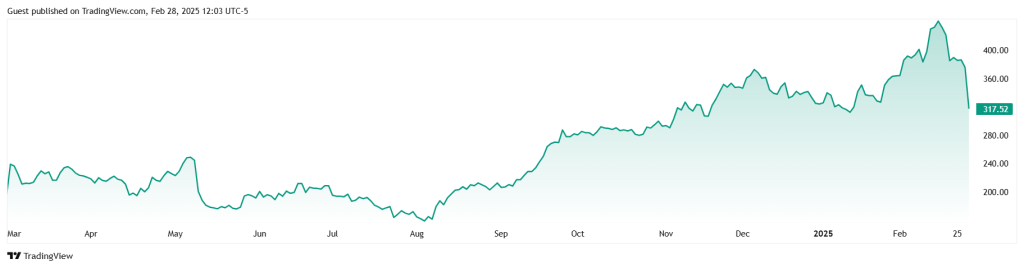

So how has Duolingo made the honorable mentions list? I believe with such a rapid decline, reliable user base and unique marketing techniques. I believe the Duolingo stock will rapidly recover. Even with the recent decline. In the past year Duolingo stock has increased by over an impressive 33%. Making it a strong pick for the coming year.

Workday (WDAY)

Workday is a cloud based platform that combines human resources and finance applications. It is designed to help businesses run more efficiently from a HR point of view. Helping businesses organize, staff and pay their workforce.

Workday is being increasingly used across many different companies. Many of my previous employers have used workday, having many interactions with it myself.

While workdays earnings for the previous year are less than impressive at -11%. The previous 5 years show a strong profit of 54%. With a recent positive earnings report boosting the stocks value. This could indicate an upward trend in the movement of the Workday stock price.

Making it a good stock to consider for 2025, indicating that growth is a very real possibility.

Procter & Gamble (PG)

Procter and Gamble is a multinational consumer goods company that makes household, personal care and food products. Aimed at being well within the essential consumer space.

This makes it a particularly prevalent choice for the honorable mentions. During times of economic uncertainty and downturn. Companies supplying consumer goods tend to excel. People still need to spend money on the essentials, providing a steady income stream.

While the gains on share prices are less than impressive, they are consistently in the positive. A lot more than many stock can claim. In the past year the PG share price has increased by over 8%. Still green from the previous month, unaffected by the downturn that has affected so many other stocks.

The reason I have chosen to not make PG stock of the month, is I want to chase higher percentages with The Effortless Portfolio. An investment in PG would no doubt be safe and profitable, but moderate.

March 2025 Stock Pick:

ServiceNow (NOW)

Like Workday, ServiceNow is a cloud-based software platform that helps businesses automate workflows and manage IT services. It uses AI to help businesses improve the customer and employee experience. A common buzz word in the stock market today.

ServiceNow helps streamline efficiency. Something that is drastically needed in many workplaces today. This provides the company with a near limitless customer base. Steadily growing and improving their platform as time wears on.

Now like most stocks, ServiceNow has suffered through the unstable February. Being down a total of 20%, so why is it our stock pick of the month?

With this sudden and drastic drop, I believe ServiceNow is likely to recover some percentage points over the coming month. On top of this, it is still up 20% from the past year. Showing it has potential for massive growth. As it emerges into more and more workplaces. I believe ServiceNow will diversify their platform, accelerating their growth rapidly in the near future. Making it a worthy pick for the March stock of the month.

NOW is added to The Effortless Portfolio, our investment of £100 gives us about 0.137 shares. At a price of $917.5 per share. Let me know what your stock of the month would have been below.

Leave a comment