The Effortless Portfolio:

Are you tired of not knowing what stock to invest in? Endlessly searching the market for the perfect stock? Want to build wealth without the constant stress of deciding what to invest in?

When I started investing as a young student, I had no idea what to invest in. I didn’t know what made a stock profitable, risky or the precautions to take. Over the years I have learned how to choose profitable stocks, with reasonable returns.

As part of Effortless Investing, I will pick stocks over the course of the year. These stocks will be invested in as part of the “Effortless Portfolio”. It will be entirely up to you if you want to copy these picks. I urge you to use your own judgment before investing in them if you wish to do so.

These investments are aimed at beginners. Looking to get started with their investment portfolio. Who want to be hand’s off over the course of the year, allowing their investments to appreciate without input.

Creating a curated selection of stocks for the “Effortless Portfolio”.

The format:

I will be explaining my reasoning behind choosing these stocks, following their growth over the course of the year. At the end of the year we will total the profit (or loss) the Effortless Portfolio has made. We will also review things we have done well, things we could improve on and reflect on the journey.

The point of these picks is not to show the growth that can be made. Instead, they aim to show the reasoning behind them. Helping inform you on what makes a strong stock and how they can be expected to perform.

Important Note: I am merely suggesting investment in these stocks. Your own judgment should be used. These stocks could fall and lose you money. These are merely the stocks I believe will increase over the course of the year. Suitability of stock may vary based on individual risk tolerance.

Before we begin we are going to set ourselves some rules to ensure consistency over the course of the year:

- Only one stock will be chosen each month. In reality it would be good practice to split monthly investments between multiple stocks. For this example though, we want to keep things simple. Other stocks that would be good candidates may also be mentioned.

- We will act as though we are investing £100 each month. Returns will be given as a percentage. This will show the growth of the Effortless Portfolio.

- Profit will be shown only as stock growth, changes in currency value will not be included. For example, if a stock appreciates 20% but the value of the pound grows 5%. Profit will be shown as 20%.

- As I will have to write the blog ahead of releasing the stock. I will chart the exact date, time and price of when the stock was transferred into the Effortless Portfolio.

So with the rules outlined, lets get started on making arguably our most important pick. The January pick is going to have the longest amount of time to grow over the course of the year. So with this pick I would like to make it based around a technology that feels like sci-fi. AI has become commonplace over the course of 2024. Many companies making fortunes either developing AI directly or investing in the infrastructure required to improve it.

Honorable Mentions:

Many companies are investing in the advent of AI (and our eventual demise). Here are some of the bigger names involved in AI.

Nvidia (NVDA)

Nvidia designs and sells GPUs for gaming, cryptocurrency mining and professional applications. However Nvidia’s compute and networking business segment which includes AI has grown to be its biggest revenue sector. Nvidia stock had an almost unprecedented growth during 2024, often making a name for itself in headlines across the world.

The stock grew by 200% in 2024. Meaning if we had invested our £100 at the beginning of 2024, it would now be worth a whopping £300. During 2024 the stock underwent a 10 to 1 stock split. Making the stock appear more affordable for many people, increasing the range of people willing to invest in it. I am sure Nvidia is set to have another profitable year during 2025. However, I am not choosing to make it this month’s stock.

The reasons for not making it this months choice, is I believe Nvidia has already undergone its large growth. A 200% increase in a stock is a whopping gain within a year. While there is plenty of opportunity for the stock to grow during 2025, there is also the risk of it being overvalued. The high expectations for the stock can leave investors disappointed after financial reviews. Although Nvidia performs extremely well during these reviews, high expectations result in the stock dropping. The rapid gain of Nvidia also leaves room for a decline. Stocks that grow quickly can fall due to destabilizing.

While I am certain this will not be the case for Nvidia, we are looking to minimize risk for the Effortless Portfolio. Sometimes peace of mind can be worth more than taking risks for a slightly higher profit.

At the time of writing, the Nvidia stock price is sat at $144.99.

Intel (INTC)

For honorable mention number 2, we are going to choose Intel. The company is a well known manufacturer and seller of computer components. For both business and consumer markets.

At Computex 2024 (an international information technology show) intel introduced technologies enhancing performance and power efficiency for data centers, AI acceleration and PC’s. Leading the industry towards a more sustainable future. This launched the company forward, placing it into headlines with its approach to AI involvement.

AI involvement has become a recent keyword in the stock market. Seemingly there mere mention of it will propel the value of a stock upwards without a second thought. Intel’s mention of it could mark the beginning of an extremely profitable year for them. Why aren’t we investing in it this month?

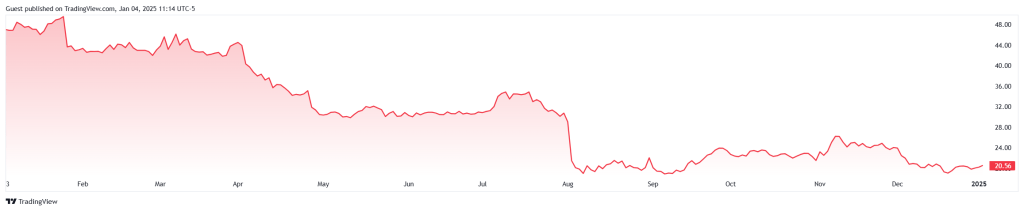

Over the previous year Intel stock has fallen by -56%, meaning if we had invested in it a year ago. We would have less than half our investment left. Although since August 2024 it has not had any major drops, this could signal growth during 2025. The stock has not fallen significantly further since August 2024.

This could indicate that Intel is now undervalued, leaving potential for growth during 2025. For the Effortless Investing portfolio however, we are looking to invest in stocks with reliable growth. While there is definite potential for Intel stock price to grow. Unfortunately there is equal opportunity for it to fall further.

At the time of writing, the Intel stock price is sitting at $20.56.

January 2025 Stock Pick:

Alphabet (GOOGL)

For the first ever Effortless Investing stock pick of the month we have… Drumroll please… Alphabet!

Alphabet is best known for owning Google, alongside other companies such as Youtube, Waze and Nest. Alphabet has an AI model named Gemini that is available through their search engine and on a variety of their platforms. Gemini rivals AI giants OpenAI’s ChatGPT. While ChatGPT may be better known. Gemini has seamless integration with Google Workspace, concise responses and limitless technical applications.

While I am no AI expert, I have been using Gemini for daily personal tasks and have been greatly enjoying my experience. Its integration into Alphabet’s products have made it easy to use without second thought. I believe 2025 will be a good year for Alphabet and Gemini, continuing to forge their way into AI development.

Also with owning massive names such as Google. The likelihood of Alphabet going bankrupt and losing our investment is extremely low. Alphabet has long been a profitable company with tried and tested products. Companies that are household names are rarely a risky investment. Unless they have a history of unreliable returns.

Over the past year the value of Alphabet Inc Class A (GOOGL) stock has risen by 38.56%. Meaning if we had invested our £100 a year ago it would now be worth £138.56. A very impressive return, however not so impressive that I believe the stock is at risk of a rapid decline. Over the previous 5 years the value has increased by over 183%, showing a general uptrend. A general uptrend is important to show a stock is capable of long term growth.

So there you have it, our choice of the month is Alphabet. At the time of writing stock is sitting at $191.79. Meaning our £100 gives us about 0.65 shares after fee’s and brokerages margins.

Thanks for reading, I’ll see you next time. In the meantime, stay profitable!

Leave a comment