The beginning of my journey:

I still vividly remember the day I started investing, I had been at University for about a year and I had just received my first bursary. £500 straight into my account, no need to pay it back, nothing I needed to spend it on, no strings attached.

I did what I considered to be adequate research. Then, I opened my first trading account. This happened from my room in a small shared flat. Gone are the days of standing on the floor of the exchange, shouting at one another. My first trading account was started with a few clicks on my phone at a popular online platform.

Funding my account with £300 of my bursary and spending the remaining £200 as many university students do (on many, many pints). I took to making my first trades. At the time I decided to trade crude oil, it was then as it is now, extremely volatile.

The sharp ups and downs of the crude oil market gave me an opportunity. I made trades with high leverages for a few minutes at a time. Setting a fairly tight take profit and a much more relaxed stop loss. Making about £15 a trade, allowing me to create massive percentages of my portfolio in just a few hours.

A few people on the platform had started copying my trades. I was ranked with a high percentage return. Unsurprisingly, after I had nearly doubled my original investment, the oil market crashed. My account was burnt, dropped to zero, worthless. To people who have a background in trading this will come as no surprise, I took big risks, made big rewards but in the end this resulted in my downfall. After the loss I blamed exchange, swore off trading for a while, spurned by the stock market.

To many people this will feel like a familiar story, to many people it will sound alien. Investing and the stock market can seem daunting, especially for beginners. For people looking to get started, it can seem like a near impossible task. Those who take the leap are often burnt by a lack of experience or bad luck.

A couple of years later I decided to get into day-trading again. This time doing further research. Managing risk, putting a large amount of time into choosing stocks. This time I was much more profitable, making albeit a lower profit but in a much safer way. I focused more on my investments. They required a large amount of time.

As a result, my grades started to suffer, I failed a year and had to resit exams over the summer. Deciding to put my investing to one side while I focused on exams.

To me the following things became important for my investing approach:

- Consistent returns.

- A reduced risk of losing my money.

- Low amount of time required.

- Higher interest rates than savings accounts.

This lead me to develop my approach to “effortless” investing.

Recently over the Christmas break while visiting family, my brother started to quiz me on the best stocks to invest in. It struck me while explaining that there is no magic stock that will make you rich. To a lot of people this isn’t clear. Certainly it wasn’t to me when I first began investing, but somewhere along the road I had forgotten that. Investing can work for anyone. More often than not, the secret to success doesn’t lie in the stocks they choose. It lies in the strategy they follow.

These are the steps that lead me to creating this blog. A place for me to share my effortless approach to investing.

The effortless approach:

This is where I come in, after many years trading, investing and being burnt many, many times. I’ve finally found the form of investing that works for me, the way that makes my money work for me with minimal effort, the “effortless” approach.

This form of investing came after years of learning and research, reading books, analyzing graphs, trial and error. While everyone trips and falls somewhere along the bumpy road of their investing journey, I am here to try and make the road as smooth and hassle free as possible. I am here to impart you with some of my hard earned knowledge, hopefully kickstarting the beginners looking to get started with investing and turning the burned investor into one with more happy returns.

So here’s a little about my approach as the Effortless Investor, it won’t work for those looking to make millions in a few hours to retire on a yacht and sail away into the sunset. If you are looking for these things:

- To make a moderate return on your investment.

- To make your money start working for you.

- To become financially free.

- To save time to pursue the things you enjoy.

- To save more money for retirement.

Then this might be for you, the effortless approach aims to produce repeatable returns better than a standard savings account can offer. It will do this with minimal input providing large returns over a large timescale. While it may seem less glamourous than the standard “get rich quick” schemes, I assure you it is much more reliable and the results speak for themselves.

Why it works:

A study by Fidelity in 2014 over a 10-year period showed that the investors with the best returns were dead! Coming in at a close second place were people that had forgotten they had made investments. So what can we infer from this? While the hands off approach to investing may seem like a luxury, and that there may be more profits to be made from monitoring graphs and buying and selling all day long.

The study by Fidelity shows that the hands off approach can be an investors greatest strength. When watching the value of investments dwindle as the stock market begins to crash can be scary, many people begin to panic and sell their investments at a loss. At a time when they should really be buying, getting stocks at the bargain prices they are available at during the crash. The best way to think of it is as the normal stocks you would buy, being at bargain prices, on discount.

There are also mistakes that can be made when the stock market is on the rise, it’s easy to want to cash-out on returns when you’ve made a healthy profit on an investment, and sometimes you should! But when you sell your investment you’re killing the profit that will be made over time when it rises further.

For the truly hands free approach, copy the most successful investors, the dead. Choose a variety of stocks that look like they will do well over the coming years, invest your money… and forget about it. Leave it in, without fussing over it, no panic selling or buying. Invest regularly and watch as your wealth compounds into something unimaginable.

The power of compounding:

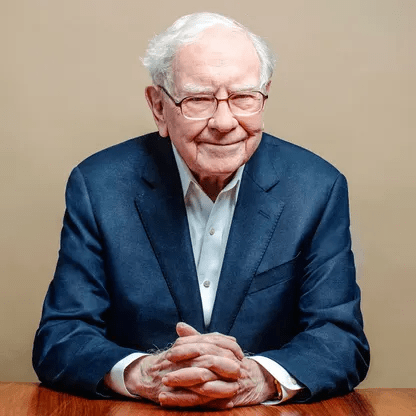

Warren Buffet is the 8th richest person in the world according to Forbes in November 2024. With a net worth of over $149.7 billion. Considered by many to be the most successful investor ever. With an average annual return of around 20%. His average annual return is impressive, but there are many investors with better annual returns, so what sets him apart?

Warren Buffet bought his first stock at the age of 11. He saved money from his paper round. Later, he sold the stock for a 4.6% gain. He had eventually saved $1000 by the age of 14 in 1944, paying $7 in tax. Today he is 94 years old with a his much more substantial net worth. He has traded actively in the stock market for 83 years. This is much more than many people still alive can claim.

Imagine being active in the stock market for 83 years. You make an attainable annual return of 10%. You invest a total of £50 a month, which sums up to £600 a year. In the year 2108 you would have amassed over £16 billion of wealth. If you had instead saved this money you would have only about £50,000.

That is the power of compound interest. Over a large timescale it can give investments the power to grow to mind-blowing proportions. We will cover how to use compound interest to our advantage in another article. We will also cover good investment practice. How to make your money work for you, and how to choose what you invest in.

I hope this has shown you a glimpse of how to achieve your financial freedom. You can learn to make your money work for you. Over the course of this blog I will suggest an investment monthly. I will explain why I believe it to be a good investment. At the end of the year, we will total our profit or loss. As well as teaching good investment strategy and informing on my own personal experience.

Congratulations on starting your journey on the long and bumpy road of investing! I hope to see you back here again. In the meantime, stay profitable!

Leave a comment